Business Owners Are Requesting Funding Today.

Most Brokers Hear About It Too Late.

A live routing system delivers requests when they submit.

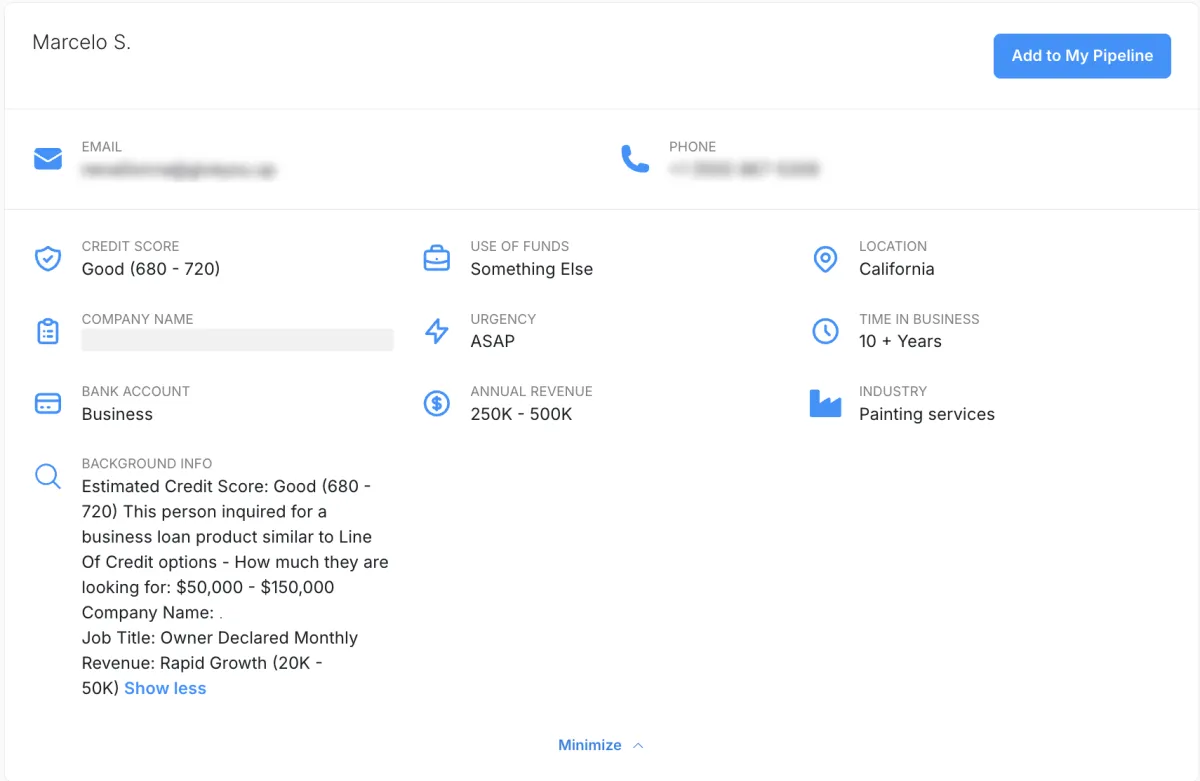

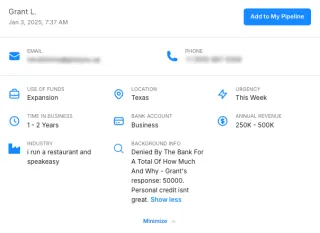

What Brokers See When a Business Requests Funding

Who is this for?

Fundly is built for business loan brokers who want live funding requests delivered through a software system — not cold lists or recycled data.

It works best for brokers who are actively placing funding and can respond when a business owner reaches out.

If you’re switching away from list-based leads and want same-day inbound requests, this will feel familiar.

If you’re looking for guaranteed deals or aren’t ready to contact leads yet, Fundly is likely not a fit — and that’s okay.

How does the system work?

Fundly connects you with business owners who actively request funding.

Requests are delivered in real time, not pulled from lists

What types of funding requests are included?

Fundly supports a range of common business funding requests, including:

Merchant Cash Advance

Equipment Financing

Business Lines of Credit

Credit Card Stacking

Working Capital

SBA-friendly requests

Expansion and inventory funding

And other standard small-business use cases

What is the minimum revenue of the leads?

Only funding requests from businesses doing at least $10,000 per month are routed to the platform.